Forex trading is one of the largest and most dynamic financial markets globally, with a daily trade volume exceeding $7 trillion. To thrive in this competitive environment, having the right tools is essential. These tools not only streamline analysis but also enhance decision-making. Whether you’re a beginner or an experienced trader, equipping yourself with these resources can significantly improve your Forex Trading performance.

1. Trading Platforms

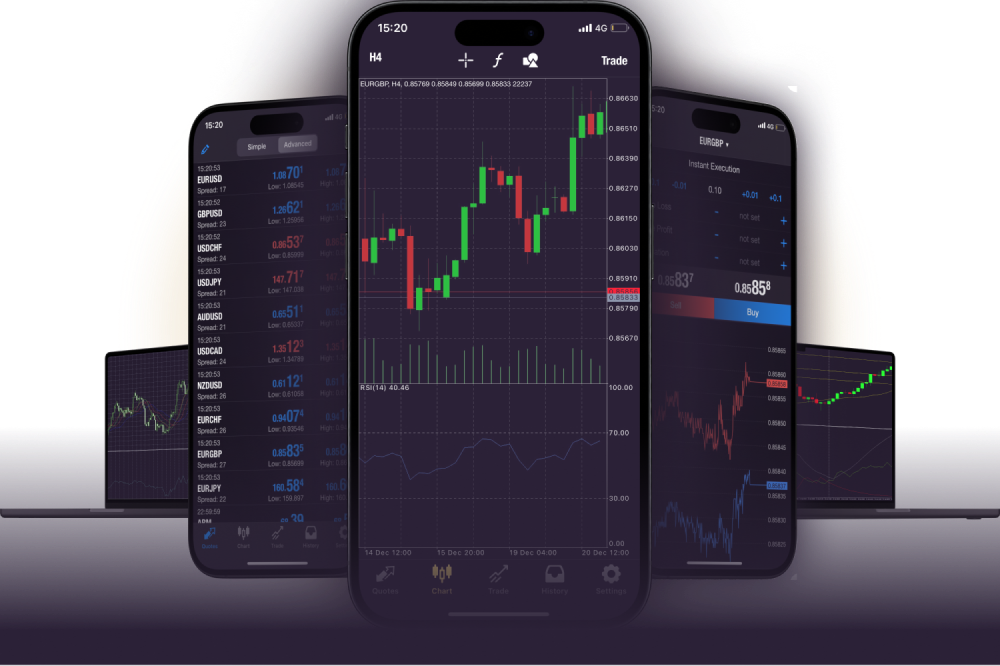

A reliable trading platform is the foundation for any forex trader. Platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are widely used for their user-friendly interfaces and advanced features. These platforms offer everything you need, from real-time price charts and technical indicators to automated trading options. For traders seeking enhanced customization, platforms like cTrader provide robust tools while allowing integration with third-party add-ons.

2. Economic Calendars

Forex markets are profoundly affected by global economic events and news. Staying informed about scheduled economic events like interest rate announcements, GDP reports, or inflation data is crucial. Economic calendars, such as those provided by Forex Factory or Investing.com, allow traders to anticipate potential market movements and plan their trades accordingly. Many traders credit these tools as indispensable when timing market entry and exit.

3. Charting and Analysis Tools

Effective analysis is key to forex trading success. Tools like TradingView stand out for their extensive range of charts, technical indicators, and social community features where traders share insights. Advanced charting options enable traders to analyze price trends, identify support and resistance levels, and forecast possible market directions. Having access to such in-depth features makes real-time decision-making simpler and more data-driven.

4. Risk Management Software

To survive in the volatile forex market, managing risk is non-negotiable. Tools like Myfxbook and Forex Risk Calculator help traders measure and manage exposure for every trade. They offer capabilities like tracking lot sizes, calculating stop-loss levels, and understanding potential drawdowns. Adopting such tools can ensure that a single wrong trade doesn’t deplete your trading account.

5. News Aggregators

Real-time information is the backbone of forex trading. Tools like Bloomberg News Terminal or Reuters Eikon provide instant updates on financial news, market trends, and political developments that directly influence currency prices. Quick access to reliable news assures traders they’re never blindsided by sudden market movements.

Forex trading success isn’t solely dependent on strategies; the tools you choose can define your edge in the market. By utilizing platforms, calendars, analytical tools, and risk management software, traders can position themselves for smarter decision-making and sustained profitability.