Contracts for Difference (CFD) Trading is a popular financial instrument that has been utilized by traders worldwide. It is a derivative trading tool that enables traders to speculate on the rise or fall of a particular asset without actually owning the underlying asset. Cfd trading provides traders an opportunity to trade on a wide range of assets such as shares, indices, currencies, and commodities. If you are new to the world of Cfd trading, this blog post will provide you with an essential guide to getting started with cfd trading.

Understanding Cfd trading:

Cfd trading is a method of investing that allows individuals to trade with leverage, which means they can control a larger position in the market with a smaller amount of capital. This type of trading can be highly profitable but can also result in significant losses if not managed correctly. Before you start trading CFDs, it is imperative to understand and manage the risks associated with this financial instrument.

Finding the Right Broker:

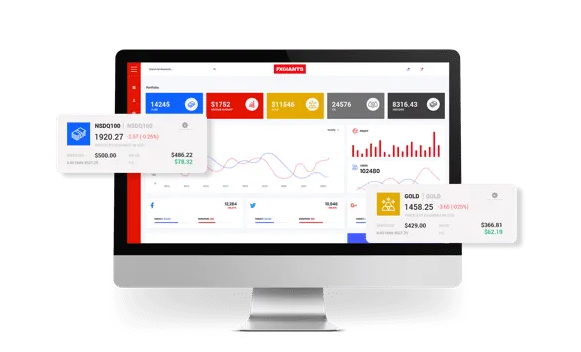

The broker you select can significantly impact the outcome of your trades. As such, it is crucial to choose a credible and transparent company that offers exceptional customer service and a good trading platform. Do your research and read reviews from other traders to find a broker that best suits your trading needs.

Identifying the Right Trades:

To increase your chances of success in Cfd trading, it is essential to identify the assets that provide the best trading opportunities. It requires a clear understanding of fundamental and technical analysis and how they apply to different markets. You must also have a trading strategy that utilizes risk/reward principles and includes proper risk management techniques.

Managing Risks:

Cfd trading carries a high level of risk, and it is essential to develop a risk management strategy that fits your trading style. It includes selecting appropriate stop loss orders, hedging your position with other trades, and not risking more than you can afford to lose. If you manage your risks correctly, you can limit your losses in times of unfavorable market conditions and maximize your profits in favorable market conditions.

Cfd trading and Taxes:

Cfd trading can come with tax implications, which can vary depending on your country’s specific tax laws. Therefore, it is essential to understand the tax requirements associated with Cfd trading in your country. Consult with a tax professional to ensure your trades are being taxed correctly, and you are not prone to any legal implications.

short:

In short, Cfd trading can provide traders with an opportunity to trade on a wide range of assets, providing potential for greater profits. It requires a fundamental understanding of the market, risk management techniques, and selecting the right brokers to achieve success. It is important to proceed with caution when trading CFDs, but if managed correctly, it can be a lucrative investment vehicle.